Garak Market in Seoul’s Songpa-gu is set to embark on a 1 trillion ($720 million) won modernization project in celebration of its 40th anniversary. Launched on June. 19, 1985, as South Korea’s first public wholesale market for agricultural and seafood products, Garak has grown into the world’s third-largest wholesale market by transaction volume, following Spain’s Mercamadrid and France’s Rungis International Market.

Despite its global ranking, Garak Market is under mounting pressure. Consumers are increasingly purchasing not only processed goods but also fresh produce through online platforms—traditionally Garak’s core business. Meanwhile, the growing number of single-person households has fueled demand for smaller, pre-packaged items, a shift the market has struggled to accommodate.

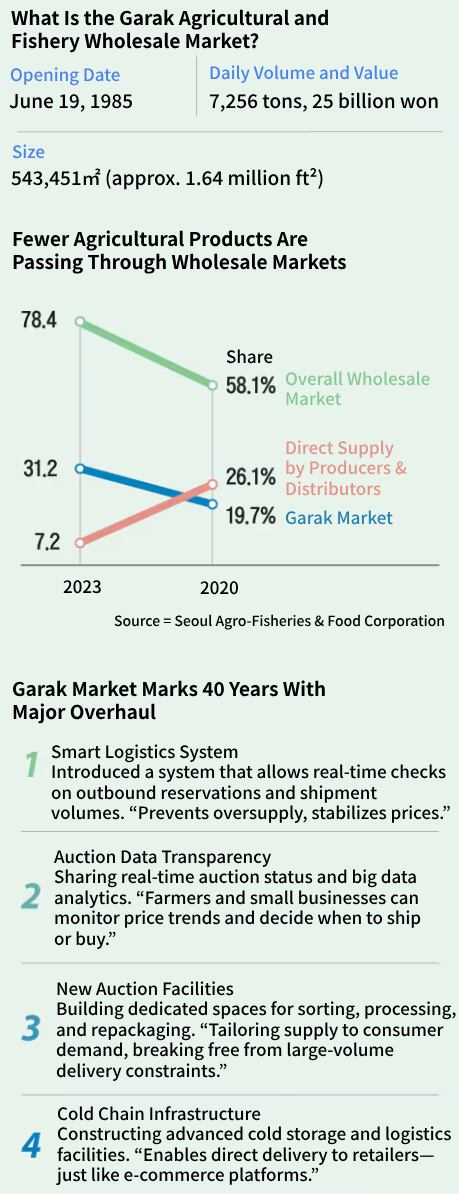

Garak still primarily operates through face-to-face trading of raw agricultural and seafood products. However, its market share is steadily eroding as distribution firms increasingly bypass traditional wholesale channels and source goods directly from producers. This trend has led to a marked decline in the proportion of domestic agricultural and seafood products distributed through Garak and similar facilities.

Even so, Garak remains the country’s most vital sales channel for farmers and fishers, handling 19.3 percent of South Korea’s total agricultural and fisheries output. Market officials plan to capitalize on Garak’s long-established industry relationships and expertise, while incorporating digital tools to offer quicker delivery and more tailored services for consumers.

In 2024 alone, Garak Market processed 2.3 million tons of goods—an average of 7,256 tons per day—with a total transaction volume of 6.24 trillion won. Each day, roughly 250 billion won worth of produce flows from Garak to food retailers, traditional markets, and supply stores nationwide. In doing so, the market serves as both a critical distribution hub and a key price-setting mechanism for South Korea’s agriculture sector.

“Prices set at Garak’s auctions directly influence those at traditional markets, department stores, and large retail chains, and even impact how food manufacturers determine their pricing,” an official from the Seoul Agro-Fisheries & Food Corporation, which manages the market, said.

Yet critics argue that Garak has leaned too heavily on its size and failed to adapt swiftly to shifting consumer preferences. The move toward e-commerce, particularly in the fresh food segment, has been especially disruptive. Major players like Coupang and Kurly now source produce directly from farms, process it at logistics centers, and deliver it to customers’ homes—often by the following morning.

“In a market where consumers expect speed and convenience, requiring buyers to show up in person is no longer sustainable,” one industry insider noted.

Retail giants and online platforms are also ramping up direct sourcing to cut distribution costs. In 2023, 99 percent of fruits and vegetables sold at Lotte Mart were procured directly. Emart followed with 93 percent, while Kurly secured 40 percent of its fresh produce through direct farm partnerships.

As a result, the wholesale market’s share of agricultural distribution has declined sharply—from 78 percent in 2003 to just 58 percent by 2020.

To counter this trend, Garak Market is pushing forward with its massive investment initiative. The central government and Seoul Metropolitan Government will each contribute 30 percent of the budget, with the remainder funded by the market’s operating entity.

Given Garak’s annual transaction volume of more than 6.2 trillion won, the investment is substantial. The overhaul will focus on upgrading aging infrastructure and introducing a smart logistics system aligned with modern distribution demands. Upon completion, the market’s cold storage capacity will grow by 3.3 times, and its food processing and repackaging facilities will expand 4.7-fold.

0 Komentar